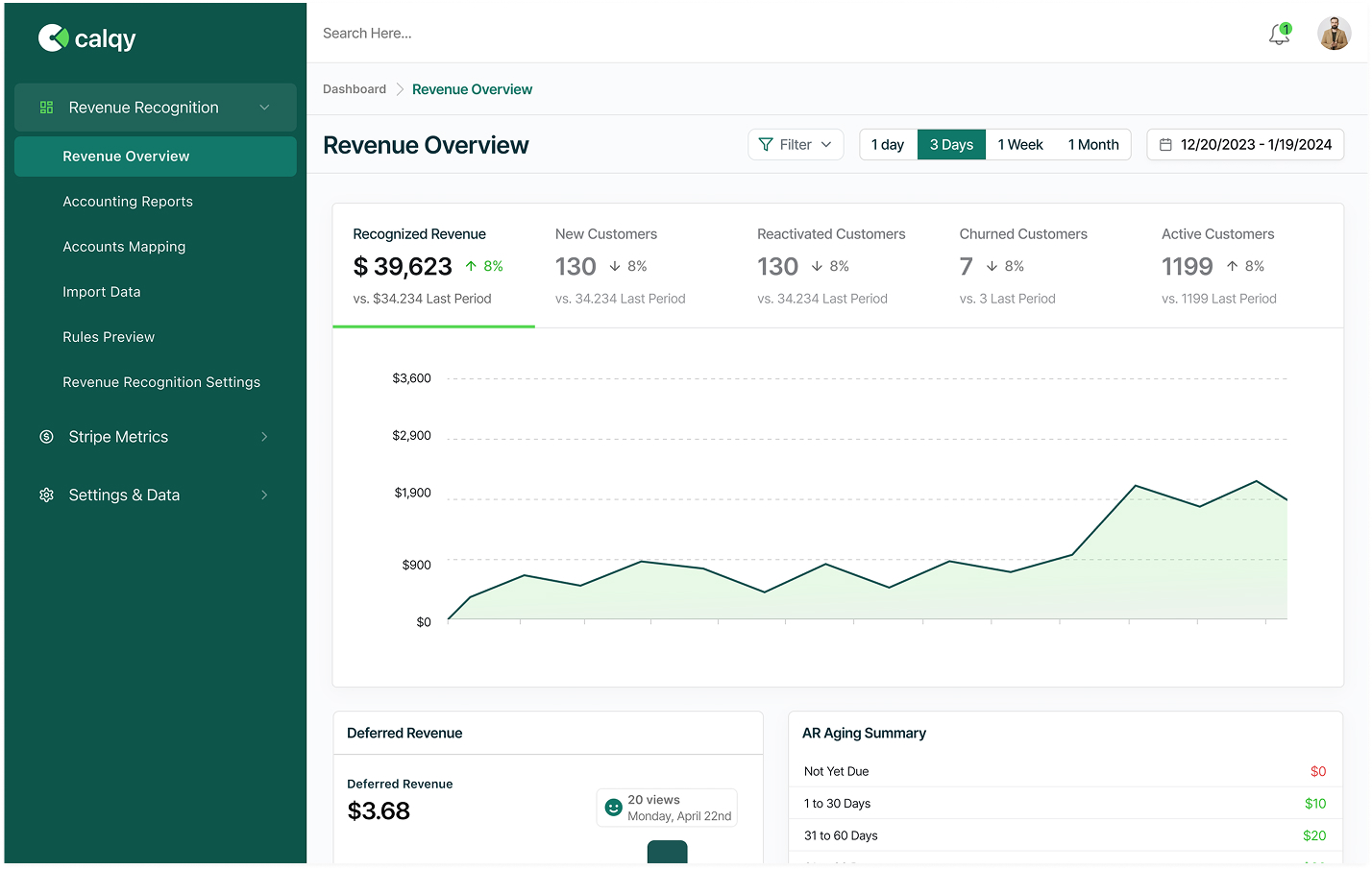

Automated Revenue Recognition for Stripe: Save Time, Reduce Errors and Stay Complaint

Calqy helps businesses automate complex revenue recognition tasks so you can focus on growing revenue instead of reconciling spreadsheets.

We understand what accuracy, compliance, and audit readiness really mean.

Why Calqy Matters?

From revenue tracking to churn reduction—Calqy gives you the insights you need to grow.

Book a Demo

Have questions? Talk to our team in under 2 minutes!

How Calqy Helps You Take Control of Your Revenue Recognition

Set up in minutes, connect your accounts, and be GAAP compliant.

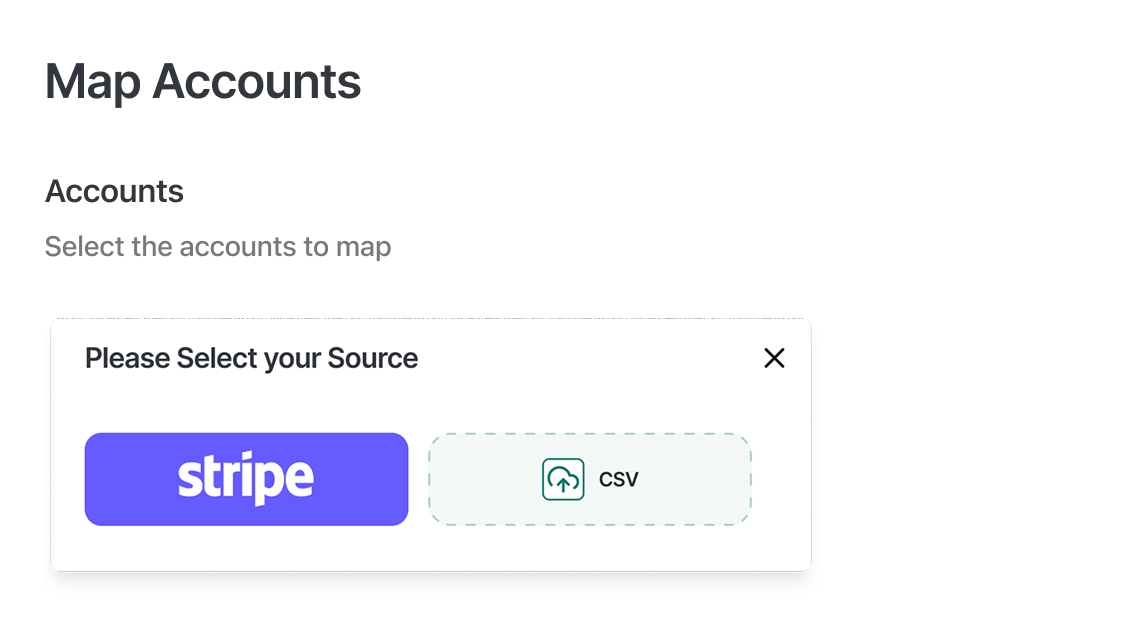

STEP 1

Connect Your Stripe Account

Securely link Stripe with just a few clicks. Calqy automatically pulls in your subscriptions, invoices, and transactions—no more manual data entry..

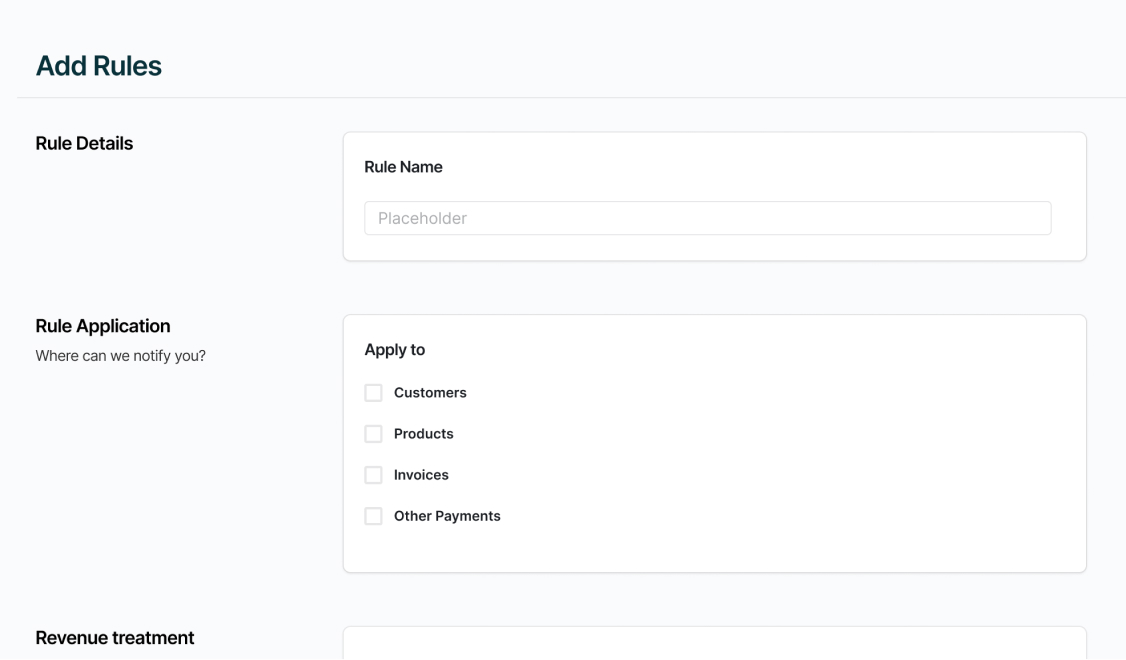

STEP 2

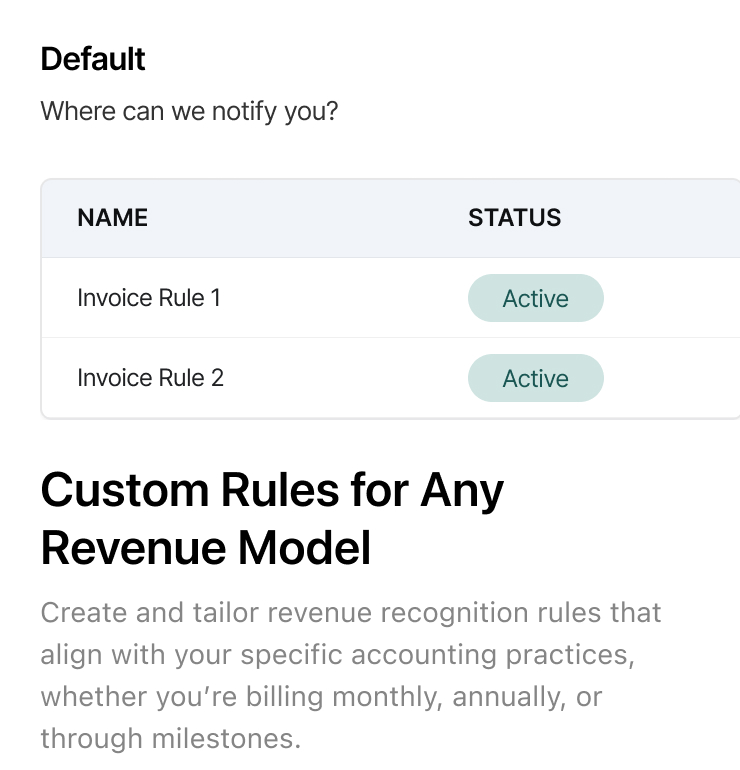

Set Your Rules

Customise how you want revenue recognised. Calqy’s intuitive rule builder ensures even complex billing scenarios are handled effortlessly and simplify compliance with ASC 606/IFRS 15.

STEP 3

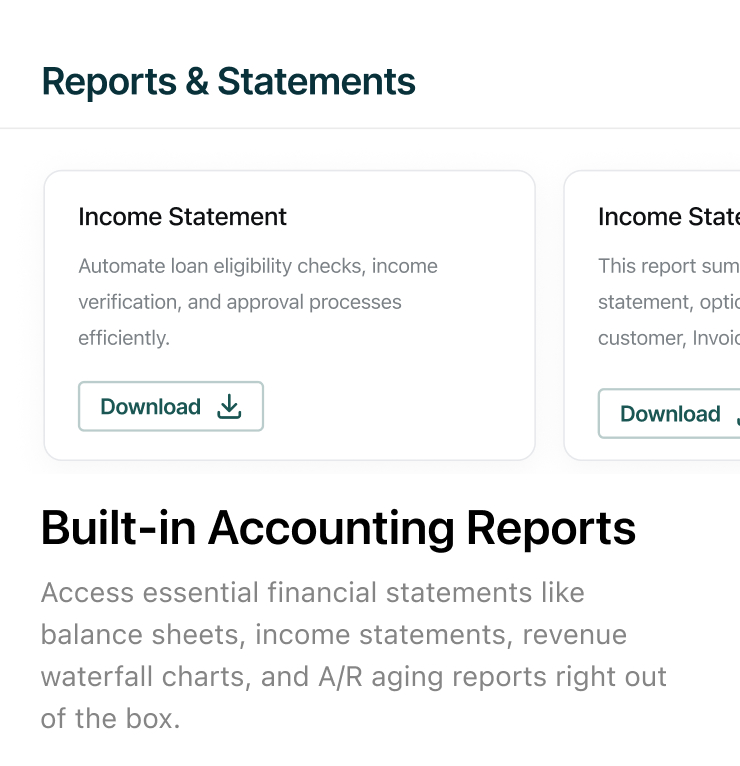

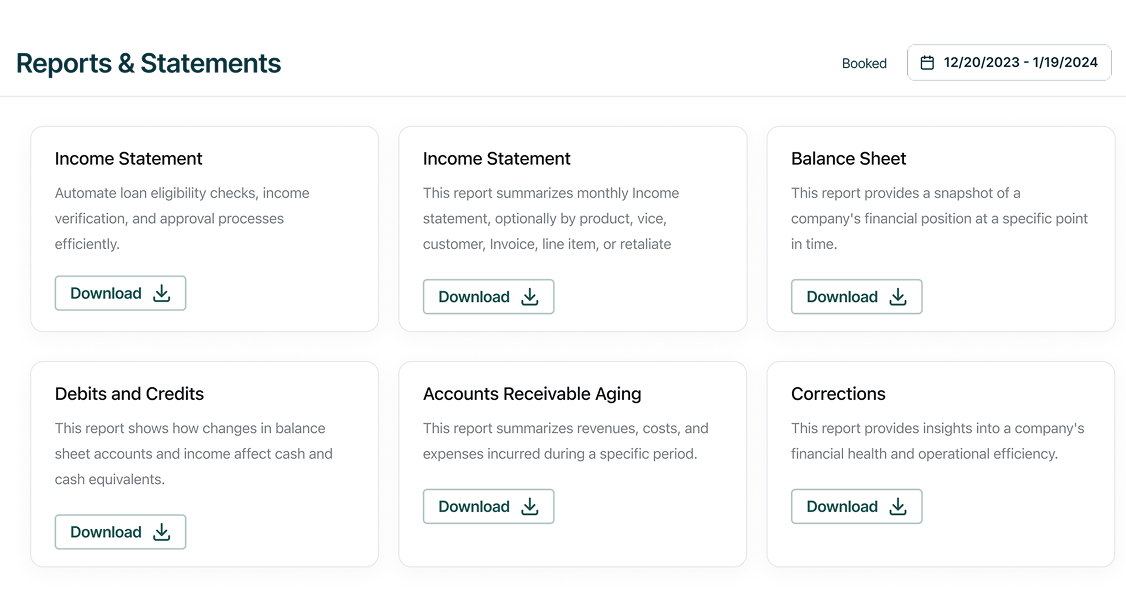

Review & Export

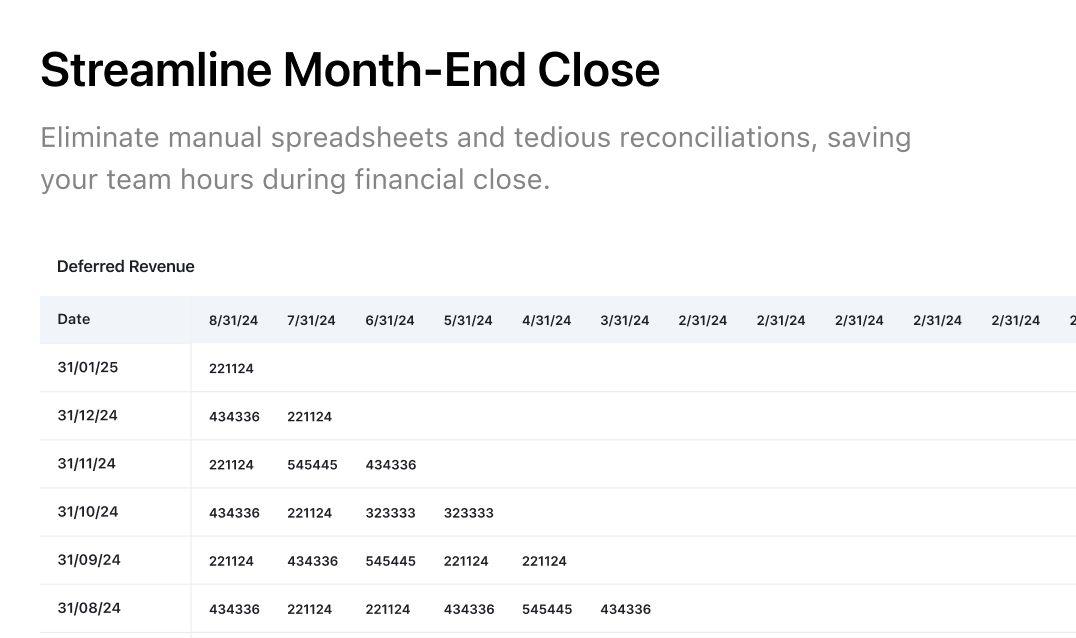

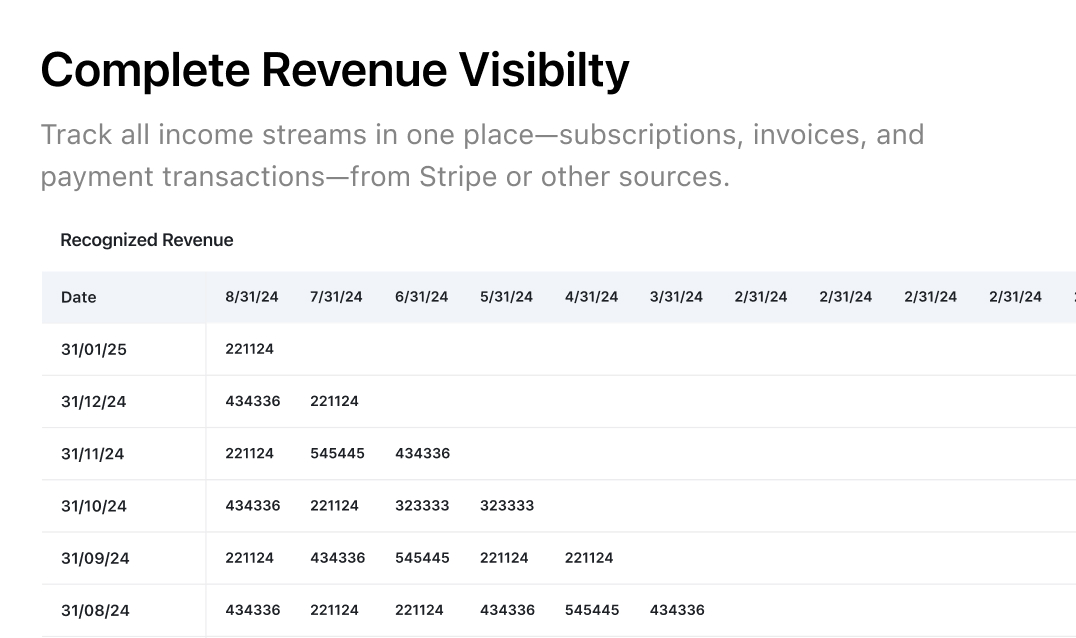

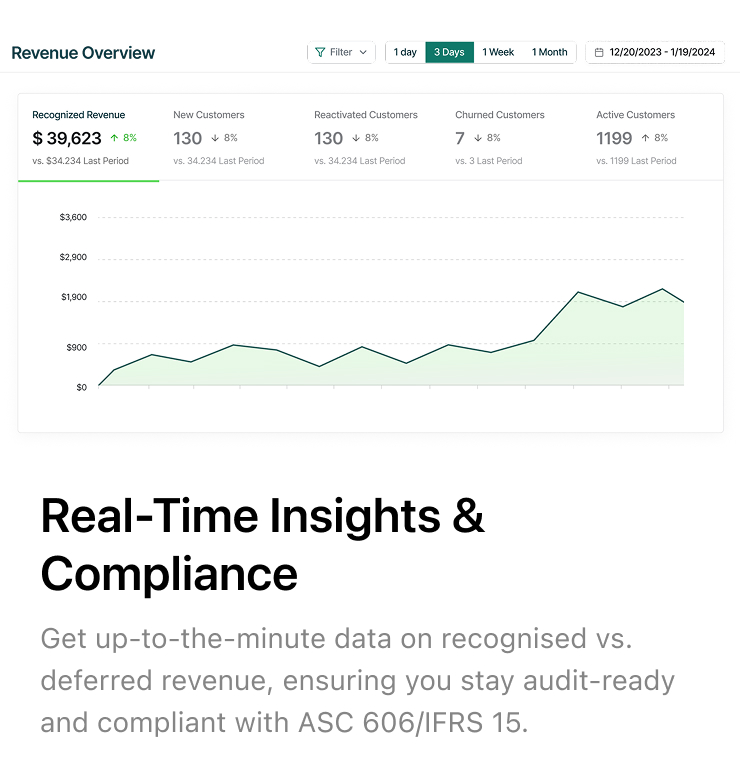

Track recognised vs. deferred revenue in real-time with dynamic dashboards. When you’re ready, generate journal entries for QuickBooks (or export to CSV). It’s fast, accurate, and fully audit-ready.

Simple, Transparent, and Startup-Friendly

ABOUT PRICING

We’re currently finalizing our pricing plans — but here’s what you can count on

✅ No hidden fees or surprise charges

✅ Flexible plans that scale with your business

✅ Special perks for early adopters

If you’re a business with a large payments volume or unique business model, reach out to discuss alternative pricing options.

Frequently Asked Questions

Everything you need to know before getting started with Calqy.

Is Calqy’s Revenue Recognition solution compliant with ASC 606 or IFRS 15?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

How does Calqy connect to Stripe?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

Can I customise my revenue recognition rules?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

Which accounting platforms do you integrate with?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

How secure is my data?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

Do I need accounting or coding expertise to use this product?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

Can I handle multiple Stripe accounts or business entities?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

How often does Calqy update recognised revenue?

Yes, Calqy gives you flexible tools to define how and when revenue is recognized. Our customizable framework enables you to set rules that adhere to recognized accounting standards, with guidance from your accounting team.

Still have questions? Feel free to Contact Us or start a free trial to see for yourself how Calqy simplifies revenue recognition.

Join our early access program for priority support and direct input on new features

Help shape the future of automated revenue recognition.oin our early access program for priority support and direct input on new features—